- Product page

Jointly issued by Cim Finance Ltd and Vivo Energy Mauritius Ltd, the Cim Shell Credit Card is a secure way for individuals and vehicle fleet owners to pay for their fuel/diesel bills and other products sold in Shell filling stations.

You must fill in an application form at one of our sub-offices and submit the required documents:

Corporate

Individuals

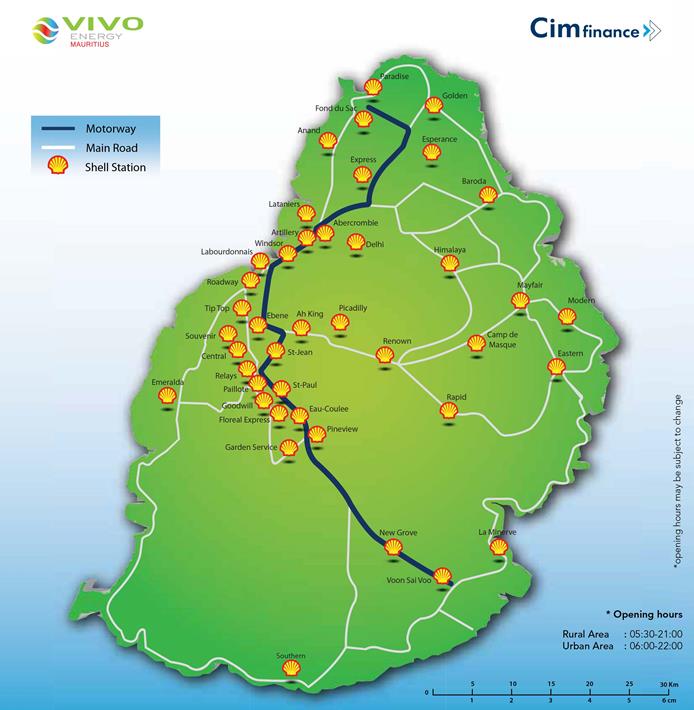

The Cim Shell Credit Card can be used in the 43 Shell filling stations across the island.

A monthly installment statement is sent to you, with details of your fuel purchases.

You must enter your PIN code for any transaction. If you forget your PIN code, contact us or call at one of our sub-offices to fill in the appropriate form. Thereafter, your new PIN code will be mailed to you.

Contact us immediately by phone on 2089090. Cim Finance offers a 24/7 service.

As soon as possible, call at one of our sub-offices, with your ID card, to fill in the appropriate form. However, a police report will be required in case of theft, fraud detection or suspicion.

If your credit limit proves insufficient for the current month, call at one of our sub-offices to apply for an increase.

Fill in the appropriate form, available at one of our sub-offices.

Fill in the Notification of Change of Address section at the back of your monthly instalment statement and mail it to our main address, together with a recent proof of address (CEB/ CWA/ MT bill). Otherwise, call at one of our sub-offices with a recent proof of address (CEB/ CWA/ MT bill) to fill in a request.

Call at one of our sub-offices with your ID card, a recent payslip or any other banking evidence (e.g. bank statement) dating from less than 3 months. You will also have to specify the vehicle licence plate and the Credit purchase limit for the new card.

Each Cim Shell Credit Card is linked to a holder’s name and a vehicle number plate. Your card must be returned to Cim Finance and you must apply for a new card.

| Annual fees | Rs 200 + TVA |

| Additional Credit card | Rs 100 + TVA |

| Interest rate on balance due | 2.1% per month (25.2% per year) |

| Fees for card replacement | Rs 100 + VAT |

| Increase in credit limit | Rs 50 |

| Penalties for late payment | % of amount due, with a minimum of Rs 150 |

| Penalty for exceeding the credit limit | 1% of amount exceeded, minimum of Rs 150 |

| Charges on cash advance | 2% of amount withdrawn (minimum Rs 100) |

| Interest rate on cash advances | 2.1% per month (25.2% per year) |

| Charges on quasi-cash* transactions | 2% of amount withdrawn (minimum Rs 100) |

| Interest rate on quasi-cash* transactions | 2.1% per month (25.2% per year) |

COPYRIGHT © 2024 CIM Financial Services Ltd | Disclaimer | Data Privacy Statement Brand online by Nova Interaction

Capital repayment

Interest paid

Please note that:

Disclaimer

Monthly rental(Rs)

Finance amount (Rs)

Residual value

Repayment term (month)

Please note that:

Capital repayment

Interest paid

Please note that:

Disclaimer

Cim Voyage

Capital repayment

Interest paid

Please note that:

Disclaimer

Credit facility